Updated October 02, 2025

TL;DR: For a bootstrapped SaaS, track a tight KPI set you can review weekly and improve monthly. Focus on MRR/ARR, CAC, LTV, churn, CAC payback, and NRR. Target LTV:CAC at or above 3:1, SMB CAC payback near 12 months, and monthly logo churn in the 1 to 2 percent range, as summarized in OpenView’s SaaS metrics guidance. Protect primary inbox placement, standardize outreach, and use AI where it cuts cost per meeting. Instantly gives you flat-fee unlimited senders, inbox placement tests, an integrated lead database, and AI agents so small teams can create a predictable pipeline without per-seat sprawl.

Understanding the fundamentals

Three fundamentals matter most for a self-funded team:

- Recurring revenue. Monthly recurring revenue (MRR) and annual recurring revenue (ARR) show health better than one-off bookings.

- Lifecycles. Lifetime value (LTV) and churn determine if you are filling or leaking the bucket.

- Unit economics. Customer acquisition cost (CAC), CAC payback, and LTV:CAC tell you how fast you can reinvest and still stay solvent.

For a bootstrapped SaaS, these are operating limits, not theory. Take it from us - we bootstrapped Instantly the entire way.

The bootstrapped edge: Why self-funded SaaS sales is different

Bootstrapping means you grow from revenue. Cash is tight, so every channel and tool must pay back fast. That constraint is an advantage because it forces focus and clean unit economics.

You prioritize:

- Short CAC payback so new cash returns quickly.

- Lower CAC channels like targeted outbound email, partner referrals, content, and PLG loops.

- Retention first. Keep churn low so growth compounds.

Table: Pros and cons of bootstrapped sales

| Pros | Cons |

|---|---|

| Capital efficient growth with more control. | Slower top-line vs VC-fueled peers. |

| Focus on profitable channels and retention. | Fewer bets at once. Prioritization pressure. |

| Pricing and roadmap align with customer demand. | Hiring and experimentation take longer. |

| Clean unit economics impress acquirers. | Less margin for error on deliverability and analytics. |

Expert advice: The State of Independent SaaS by MicroConf shows a growing, healthy bootstrapped ecosystem. Founders emphasize efficiency, cash discipline, and transparent metrics over blitz-scaling.

Core strategies for bootstrapped SaaS sales success

Start simple. Standardize a weekly motion you can measure and improve.

- Define your ICP and segment the list

- ICP clarity. Write the firmographics, pain, and tech signals that qualify or disqualify a lead.

- Verified contacts only. Keep hard bounces at or below 1 percent with ongoing list hygiene, consistent with bounce rate benchmarks.

- Build a lean outbound engine

- Two warmed inboxes to start. Ramp sends up to 30 per day per inbox (avoid going above this daily rate). Pause if placement drops.

- Two sequence variants. One clear ask. Keep the body 60 to 120 words. Boomerang’s analysis suggests 50 to 125 words tends to get more responses.

- Follow-ups. Day 3 and day 7. Short and specific. Many replies happen on follow-up two.

- Qualify fast and set meetings

- Reply triage. Classify yes, no, later, wrong person. Book from replies the same day.

- One-question discovery. Confirm pains and success criteria. Offer a short demo when fit is clear.

- Close with clear next steps

- Mutual close plan. Decision roles, timeline, pilot criteria.

- Simple pricing. Annual discount plus a monthly option for SMB.

Checklist: First 100 customers

- Define ICP and 3 pain statements in the customer’s words.

- Source 1,000 verified contacts that match the ICP.

- Warm 2 to 4 inboxes for 30 days before scale. Pass inbox placement tests at or above your internal threshold.

- Launch 2 sequences with 2 subject variants each. Track opens, replies, meetings.

- Daily QA for bounces and spam signals. Keep complaint rate below 0.3 percent. Gmail and Yahoo treat 0.3 percent as a hard ceiling for bulk senders, per the updated bulk sender requirements.

- Triage replies in a unified inbox and book meetings within 24 hours.

- Measure cost per meeting and CAC payback monthly. Adjust list and copy every 2 weeks.

Watch how you can put all these strategies to the max with Instantly on Youtube.

Also check our guide on getting your first 100 SaaS customers.

Using technology and AI for efficient SaaS sales

When headcount is lean, tools do the heavy lifting. Your stack should protect deliverability, keep costs predictable, and automate repeatable work.

- Deliverability first. Run inbox placement tests to verify primary-inbox placement before scale, and auto-pause accounts that fail. Instantly provides automated inbox placement tests, alerts, and an API, so ops can schedule checks and trigger safeguards.

- Integrated data. Pull fresh, verified leads in-product to save time. Instantly’s SuperSearch lists 450M+ contacts with waterfall enrichment, which reduces bounces and protects sender reputation.

- AI to save hours. Copilot helps with research, campaign creation, and analytics summaries. AI Reply Agent answers and advances leads in under 5 minutes with human-in-the-loop controls.

Sales engagement platforms Comparison

| Platform | Pricing model | Deliverability controls | Best for |

|---|---|---|---|

| Instantly | Flat fee with unlimited sending accounts and warmup. | Private deliverability tooling (4.2M), automated inbox placement tests, and optional SISR pools on higher tier. | Agencies and lean teams that value predictable cost and safe scale. See the plans overview. |

| Apollo | Commonly per-seat with credits. | Inbox ramp, health tools vary by plan. | Teams that want integrated data plus outreach in one system. |

| Lemlist | Commonly per-seat. | Warmup (20K network), domain health tips, personalization aids. | Multichannel tests with a strong personalization focus. |

| Outreach/Salesloft | Enterprise per-seat. | Governance and reputation controls for large teams. | Mature teams standardizing process and coaching. |

| Smartlead/Reply peers | Mix of flat and per-seat. | Warmup and rotation features. | Builders who want API-friendly options and channel mix. |

My take: Pick by cost model fit, deliverability depth, and data posture. Flat-fee economics reduce cost per meeting as volume grows.

Optimizing outreach and deliverability

Protect sender reputation before you chase volume. Most failures trace back to DNS, list hygiene, or aggressive ramps.

Checklist: Deliverability best practices

- DNS alignment. Set SPF, DKIM, and DMARC for the sending domain. Bulk senders now face stricter requirements under Google and Yahoo’s bulk sender changes.

- Warmup and ramp. Warm for about 30 days. Ramp sends 30 → 50 → 100 per inbox. Expand only after clean placement tests.

- Inbox placement tests. Run automated seed tests weekly and before scale. Pause or route to warmup if placement dips.

- List hygiene. Verify contacts. Remove risky catch-alls. Keep total bounces at or below 2 percent and hard bounces near or below 1 percent.

- Copy and cadence. Plain text, minimal links, short copy. Emails near 50 to 125 words often earn higher response rates.

- Throughput management. Respect send windows, throttle when Microsoft signals degrade, and rotate across many inboxes instead of blasting from a few.

- Complaint control. Offer a one-click unsubscribe and clear opt-out. Keep spam complaints well below 0.3 percent.

Experiment frameworks

- A/Z subject testing. Test 5 to 10 subjects at low volume for one week. Promote winners.

- Offer tests. Vary the ask, not just the copy. Meeting vs resource vs one-question reply.

- Attribution. Tag list source, segment, and copy variant. Reconcile to meetings and pipeline in your CRM.

Measuring and scaling your SaaS sales efforts

These are the essential metrics a bootstrapped SaaS should track. Measure weekly. Review trends monthly.

- MRR and ARR. Track new, expansion, contraction, and churn to see the true picture.

- CAC. Total sales and marketing cost in a period divided by net-new customers in that period.

- LTV. A practical model is ARPU divided by monthly churn. Add gross margin for precision.

- LTV:CAC. Target at or above 3:1 for healthy unit economics.

- CAC payback. Months to recover CAC from gross margin. For SMB motions, aim near or under 12 months. OpenView ties “good” payback to NDR strength and shows top performers below about 7.5 months, while 12 to 18 months appears typical across many cohorts, in their guidance on CAC payback mistakes.

- Churn. Track both logo churn and revenue churn monthly. Many B2B products sit near 1 to 2 percent monthly logo churn as they mature, per ChartMogul’s cheat sheet.

- NRR. Net revenue retention above 100 percent means expansion offsets churn. Many top B2B companies target 110 percent or more.

How to track quickly

- Billing for MRR/ARR and churn. Stripe or Chargebee dashboards can be your source of truth.

- CRM for funnel conversion and cycle length. Keep stage definitions consistent.

- Outreach analytics for replies, positive replies, meetings, and cost per meeting. Instantly reports reply classification and booked meetings in its unified inbox.

- Attribution view that reconciles outreach to meetings and opportunities.

Concept: cost-per-meeting ROI calculator

- Inputs: Tool costs, list costs, rep time, emails sent, reply rate, positive rate, meetings booked, close rate, ARPA, gross margin.

- Outputs: Cost per meeting, CAC, CAC payback months, LTV:CAC.

- Use: Tweak send caps, list sources, and copy until cost per meeting and CAC hit your targets.

Overcoming common challenges in SaaS sales

Most issues trace back to data quality, deliverability, or unclear ownership. Use this map to fix quickly.

Common sales challenges and precise fixes

| Symptom | Why it happens | Precise fix |

|---|---|---|

| High bounces | Stale or unverified data. | Re-verify. Remove risky contacts. Pause sends 48 hours. Resume at lower cap and retest placement. |

| Low opens | Spam placement or tired subjects. | Run inbox placement tests. Reduce links. Test 5 to 10 new subjects at low volume. |

| Replies but few meetings | Weak ask or slow triage. | Shorten the ask. Use AI Reply Agent to draft responses in under 5 minutes. Route to calendar instantly. |

| Churn rising | Value not realized. Poor onboarding. | Instrument activation milestones. Add a 14-day success plan and proactive outreach to at-risk accounts. |

| Costs rising | Channel mix drift. Tool sprawl. | Re-shift to efficient channels. Consolidate outreach, data, and inbox management to reduce TCO. |

Real-world context and proof points

- Buyers spend little time with sellers. Gartner’s B2B buying journey shows buyers spend about 17 percent of their buying time with all suppliers combined. Your message must land cleanly and clearly.

- SaaS spend continues to grow. Gartner forecasts 2024 public cloud spend at $675B with SaaS projected to grow year over year, and continued growth into 2025, in their cloud spending forecast.

- Healthy ranges exist. Many operators use LTV:CAC at or above 3:1 and CAC payback in the 12 to 18 month range as common reference points for sustainable growth.

- Bootstrapped success is real. Mailchimp operated bootstrapped for years before a roughly $12B acquisition by Intuit in 2021, per Intuit’s acquisition announcement. Ahrefs’ CMO has stated publicly they crossed $100M+ ARR while remaining bootstrapped.

Customer proof

"The platform is super intuitive, easy to set up, and makes it simple to manage multiple domains and inboxes at scale. Deliverability is great and the analytics give us exactly what we need to optimize campaigns quickly." - Shaiel P. on G2

"The platform is super intuitive, and I was able to get up and running in minutes. Deliverability has been excellent, and the automation features save..." - James M. on G2

"We increased our revenue by six figures within 4 months of starting with Instantly." - Alexander on Trustpilot

How Instantly supports bootstrapped SaaS economics

- Flat-fee unlimited senders and warmup. Scale throughput without per-seat penalties. See our approach to unlimited outreach pricing.

- Private deliverability tooling and SISR. Automated inbox placement tests and Light Speed’s SISR for dedicated or private pools when you need them on the inbox placement page.

- Integrated lead database. SuperSearch lists 450M+ B2B contacts with waterfall enrichment. For a quick overview of lead finding, watch this short lead finder demo.

- AI agents. Use AI Agents like Copilot for research and campaign build, and Reply Agent to answer leads in under 5 minutes with human review options.

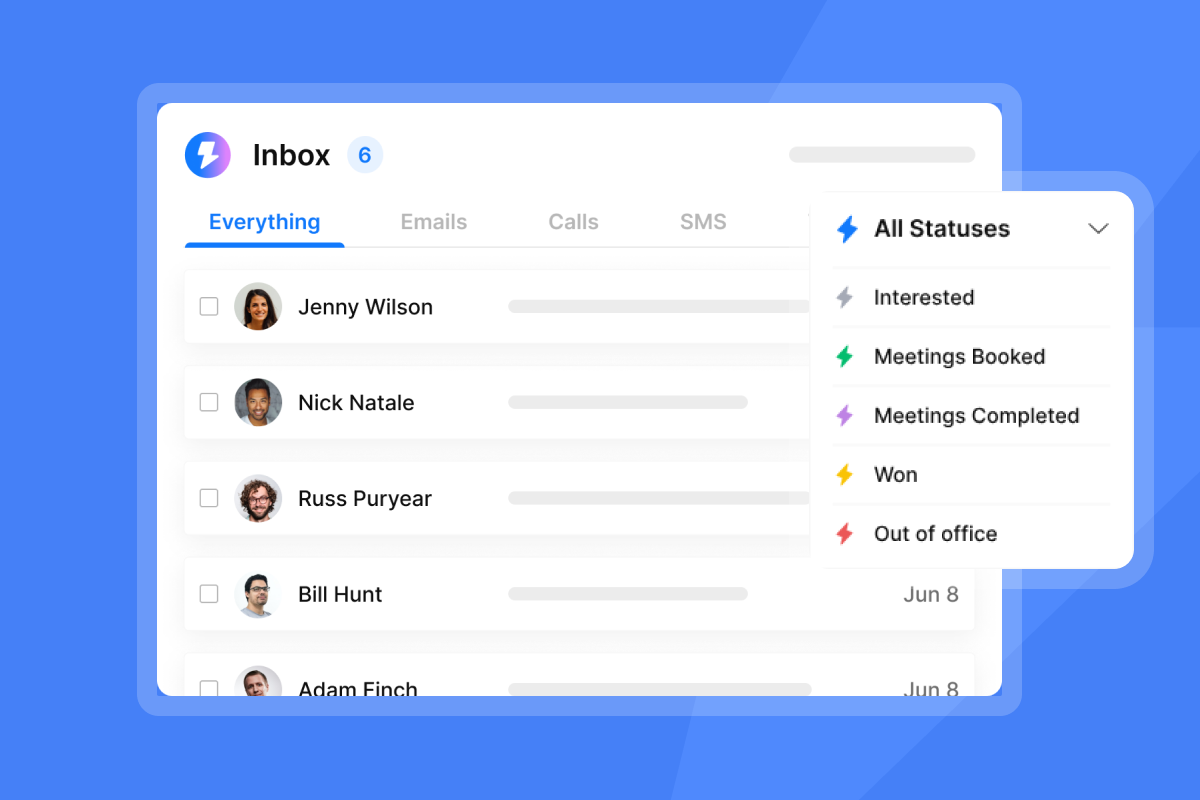

- Unified inbox. Unibox centralizes replies, labels outcomes like Meeting Booked, and helps teams act quickly.

Further learning & tutorials

- Watch the Full Instantly.ai tutorial 2025.

- Watch How to avoid cold emails going to spam.

- Watch The ultimate guide to cold email deliverability in 2025.

Driving growth with data-driven sales

Bootstrapped SaaS wins by doing fewer things better. Track a small set of metrics, protect primary-inbox placement, standardize outreach and triage, then scale what works across more inboxes. When CAC payback shortens and NRR holds above 100 percent, growth funds itself.

Ready to scale your bootstrapped SaaS sales?

Start a 14-day metric plan inside Instantly. Use unlimited inboxes, inbox placement tests, SuperSearch data, and AI Reply Agent to reduce cost per meeting with predictable pricing.

Frequently asked questions (FAQ)

- What is a good LTV:CAC ratio for a bootstrapped SaaS?

Aim for at or above 3:1. If you are below 2:1, reduce CAC or increase LTV with retention and expansion. - What CAC payback should I target?

Under about 12 months is strong for SMB motions. Twelve to 18 months is common across many cohorts, especially as deal sizes grow. Tie targets to your NRR. - What is acceptable monthly churn in B2B SaaS?

Many mature B2B products sit near 1 to 2 percent monthly logo churn. Track both logo and revenue churn. - How many inboxes do I need to book weekly meetings?

A common starting point is 2 to 4 warmed inboxes at 30 to 100 sends per day each, on verified lists with good placement. Add inboxes as reply handling capacity grows. - Which outreach metrics matter most each week?

Bounces below 2 percent, primary-inbox placement, reply rate, positive reply rate, meetings set, and cost per meeting. Keep spam complaints far below 0.3 percent.

Key terminology glossary

- ARR: Annual recurring revenue. MRR times 12.

- MRR: Monthly recurring revenue from active subscriptions.

- CAC: Customer acquisition cost. Sales and marketing spend divided by net-new customers.

- LTV: Lifetime value. A simple model is ARPU divided by monthly churn.

- CAC payback: Months to recover CAC from gross margin contribution.

- Churn: Percentage of customers or revenue lost in a period.

- NRR: Net revenue retention. Revenue from an existing cohort including expansion and churn.

- Primary inbox: The folder contacts actually read.

- Sender reputation: Trust signals mailbox providers use for placement.

- Warmup: Controlled sends and engagement to build reputation before production.

- Unified inbox: One place to triage replies across connected inboxes.